Getting approved for life insurance with cerebral palsy can be a challenging yet achievable goal. With the right approach and knowledge, you can increase your chances of securing a policy that meets your needs. Understanding how to navigate the process is essential to ensure that you get the coverage you deserve. In this article, we will explore how to get approved for life insurance with cerebral palsy the right way, the factors insurers consider, and the various life insurance options available.

Why Do People with Cerebral Palsy Have a Hard Time Getting Life Insurance?

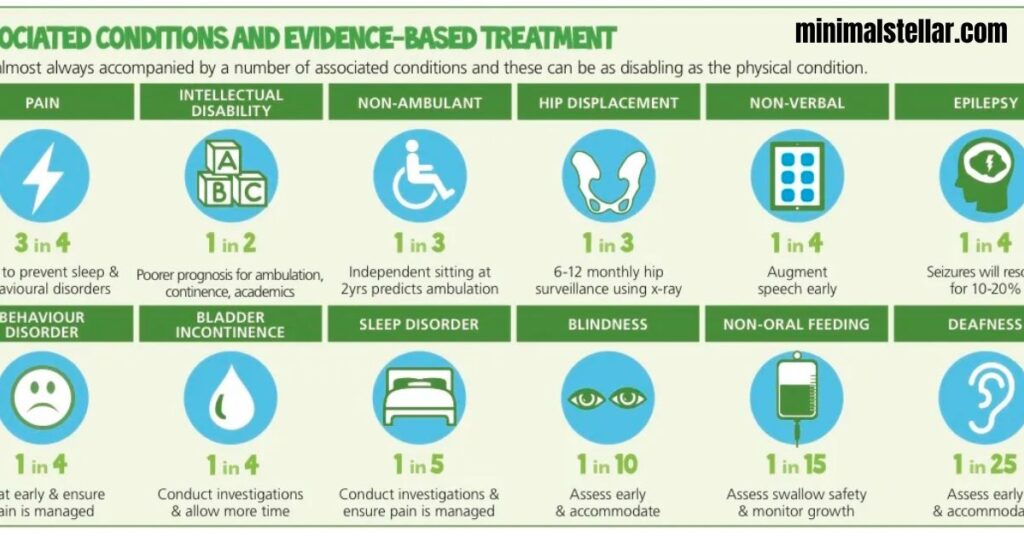

People with cerebral palsy (CP) may face obstacles in obtaining life insurance due to the nature of the condition. Cerebral palsy affects motor skills, which can lead to complications that insurers may view as high-risk. Insurance companies assess risks based on medical history, current health status, and the severity of the condition. Individuals with CP may have additional health concerns, such as respiratory issues, mobility challenges, and intellectual disabilities, that can affect their life expectancy. These factors can result in higher premiums or even denial of coverage in some cases. How to get approved for life insurance with cerebral palsy the right way.

However, it is important to note that not everyone with cerebral palsy will face the same challenges when applying for life insurance. The key to success lies in providing thorough documentation of your health status, including details about how well you manage your condition, your treatment plan, and your overall lifestyle. This can help insurance companies make a more informed decision about your eligibility for coverage.

Underwriting for People with Cerebral Palsy

Underwriting is the process that insurance companies use to assess the risk of insuring an individual. For people with cerebral palsy, this process involves evaluating the severity of the condition, any associated medical complications, and the applicant’s overall health. Depending on the level of cerebral palsy, individuals may need to provide additional documentation such as medical records, letters from healthcare providers, and any therapy or treatment plans they follow.

The underwriting process may vary depending on the type of life insurance you are applying for. Some policies, such as guaranteed issue or simplified issue life insurance, may have more lenient underwriting standards, while traditional term or whole life policies often require more detailed medical information. It’s important to understand the different options available and choose the one that best suits your needs.

How Does Employment Play a Role?

Employment plays a significant role in determining life insurance eligibility. Insurance companies consider your employment status and income when assessing your risk profile. A stable job and steady income can demonstrate that you are capable of managing your condition and supporting your dependents. Employment stability can also give insurers confidence that you are financially responsible and less likely to be a high-risk applicant.

For individuals with cerebral palsy, employment history can provide insight into how well they manage their health and the impact of their condition on daily life. For example, a person with CP who has held a steady job for several years and has shown dedication to their career may be viewed more favorably by insurers than someone who has had frequent job changes or gaps in employment due to health concerns.

Life Insurance Options for People with Cerebral Palsy

When it comes to life insurance for people with cerebral palsy, there are several options to consider. The right policy depends on the severity of the condition, the applicant’s health, and their specific needs.

Mild Case of Cerebral Palsy

For individuals with a mild case of cerebral palsy, life insurance may be easier to obtain, especially if there are no other significant health concerns. These individuals may qualify for standard life insurance rates, depending on their overall health and lifestyle choices. In some cases, insurers may offer favorable premiums due to the relatively low risk associated with mild CP.

Moderate Case of Cerebral Palsy

A moderate case of cerebral palsy may present more challenges, but it is still possible to obtain life insurance. The underwriting process may involve additional scrutiny, and premiums may be higher to account for the increased risk. However, many individuals with moderate CP can still qualify for coverage, especially if they have managed their condition well and maintain a healthy lifestyle.

Severe Cerebral Palsy

People with severe cerebral palsy may face more difficulties when applying for life insurance due to the higher risk associated with the condition. In many cases, life insurance policies may be denied, or the premiums may be significantly higher. However, it is still possible to secure coverage, particularly if the applicant has a stable support system, such as caregivers or family members, who can provide additional documentation of their care needs.

Life Insurance for Children with Cerebral Palsy

Securing life insurance for a child with cerebral palsy may seem daunting, but it is not impossible. Parents or guardians can purchase life insurance policies on behalf of a child with CP, and these policies may offer coverage for the child’s future. The policy’s premium rates will depend on the severity of the condition, but early application may provide a chance to secure coverage before any health complications arise.

Life Insurance on Your Child with Cerebral Palsy

When purchasing life insurance on a child with cerebral palsy, it’s essential to focus on the long-term benefits. These policies may include savings or investment components that can help fund the child’s future healthcare needs. Additionally, having life insurance in place early on ensures that the child will have coverage if their health worsens as they age. This type of policy offers peace of mind to parents, knowing that their child’s financial security is protected.

Life Insurance on Yourself

When applying for life insurance as an individual with cerebral palsy, it’s important to work with an insurance agent who understands the nuances of the condition. They can help you navigate the application process and find the best policy for your needs. Whether you are looking for term life insurance, whole life insurance, or a more specialized policy, it’s crucial to disclose all relevant medical information to ensure you receive accurate quotes and coverage options.

Exploring the Latest Trends: Webfreen.com Fashion Unveiled

Now You Know: People with Cerebral Palsy Can Obtain Life Insurance

It is entirely possible for individuals with cerebral palsy to obtain life insurance, though the process may require extra effort and planning. By understanding the underwriting process, choosing the right policy, and providing thorough documentation of your health, you can increase your chances of getting approved for life insurance. Whether you have mild, moderate, or severe CP, there are options available that can help protect your financial future.

Conclusion

Navigating the world of life insurance with cerebral palsy can feel overwhelming, but it’s important to know that there are viable options available. By understanding how to get approved for life insurance with cerebral palsy the right way, individuals can find policies that suit their needs and offer long-term protection. Key factors such as health status, employment, and the severity of the condition play a major role in determining eligibility.

Despite the challenges, securing life insurance with cerebral palsy is possible. Whether you are applying for yourself or for a child, taking the time to understand the process, work with knowledgeable agents, and provide the right documentation can help ensure a successful outcome. With the right information and approach, you can protect your financial future and gain peace of mind knowing you have the coverage you need.

How to Choose the Perfect Fashion Nails for Your Style

Frequently Asked Questions (FAQs)

How can I increase my chances of getting life insurance with cerebral palsy?

By maintaining a healthy lifestyle, working with an experienced insurance agent, and providing clear documentation of your health and treatment plan, you can increase your chances of getting life insurance approval.

Will my premiums be higher because of my cerebral palsy?

Premiums may be higher if you have cerebral palsy, particularly if your condition is more severe. However, each case is unique, and some individuals with mild CP may qualify for standard rates.

Can I get life insurance for my child with cerebral palsy?

Yes, you can purchase life insurance for your child with cerebral palsy. Policies are available that can offer long-term coverage and financial protection for your child’s future.

Is there a specific type of life insurance that works best for people with cerebral palsy?

The type of life insurance that works best depends on the severity of your condition. Options include term life, whole life, and guaranteed issue policies, each offering different levels of coverage and premiums.

What happens if I’m denied life insurance due to my cerebral palsy?

If you’re denied life insurance due to cerebral palsy, you can explore alternative options such as guaranteed issue policies or work with specialized insurers who may be more willing to provide coverage for individuals with pre-existing conditions.

Eliana Amelia is the insightful author behind Minimal Stellar. With extensive experience in blogging, she expertly crafts content on the latest hair trends and cutting techniques. Eliana’s passion for haircare and style, combined with her professional expertise, ensures that her readers receive valuable, up-to-date advice. Her dedication to helping others look and feel their best shines through in every post.